- | 9:01 am

Inside the lucrative business of a metaverse landlord, where monthly rent can hit $60,000 per property

With global brands renting space and profit margins near 70%, leasing virtual land is big business.

In the rush to build the metaverse, Sam Huber has had a head start.

“I’ve been personally buying virtual lands since 2017,” says Huber. His London-based company, Admix, has found a surprisingly lucrative business turning that virtual real estate into actual money. Working with brands ranging from McDonald’s to Pepsi to Formula One racing, Admix has been buying space in various metaverse platforms like Decentraland and the Sandbox and leasing them to companies interested in dabbling inside this new online virtual space.

Depending on the size of the space and the metaverse platform where it’s located, Huber says his company has bought virtual real estate for the equivalent of anywhere between $20,000 and $1 million recently, in the form of cryptocurrency. On the high end, building out a metaverse experience on one of those plots of land and leasing it back to a company can get monthly rents upwards of $60,000. Huber says that on some projects, Admix has pulled in profits upwards of 70%. “It’s highly profitable,” he says.

Huber is likely one of the longest established metaverse landlords in this nascent business. The company is like a real estate conglomerate that develops buildings and then leases them out to clients—a business model that’s operated in the real world for thousands of years.

And just as in the real world, a metaverse real estate business is most successful when one can buy low and sell (or lease) high. Huber says the cost of virtual land has grown by a factor of five every year since he began investing. “As this continues, every single brand is going to be priced out of buying,” he says. “So if you own land today, you have a lot of flexibility and options.”

As a relatively longtime metaverse landowner, Huber has found that companies are still wary about purchasing virtual property. “Most of the brands don’t actually want to make a bet in this space yet. It’s too early, they don’t know which platform they want to be on, and they don’t really want to make an expensive purchase,” he says. Renting “is a way for them to get started at a lower cost.”

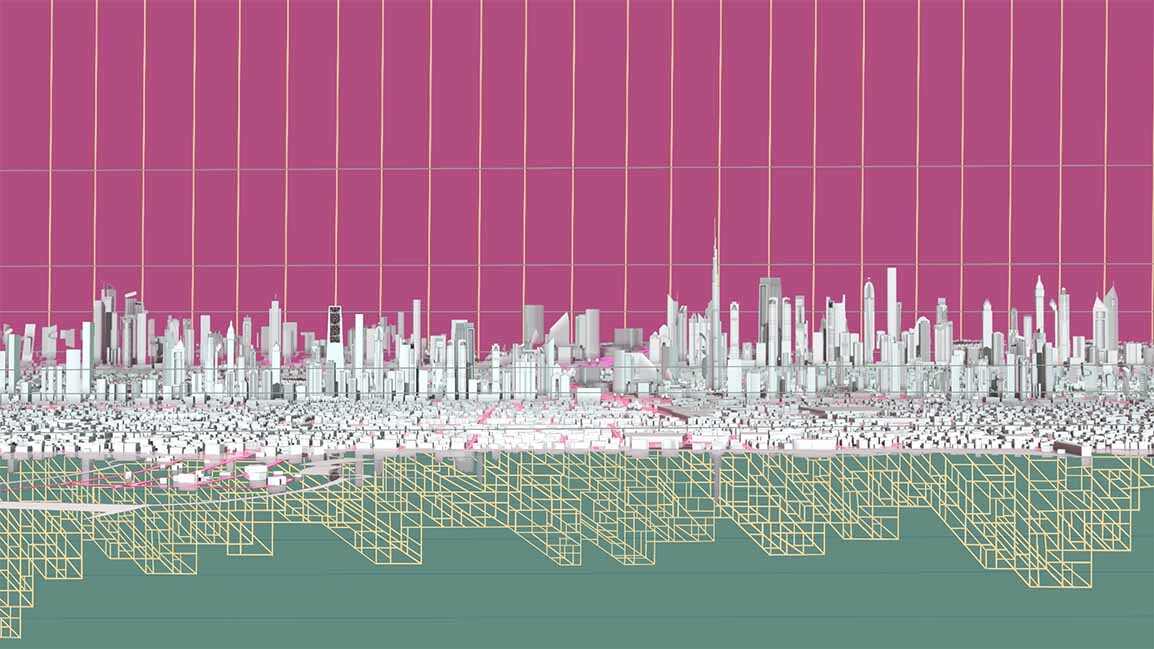

Admix has built a wide variety of virtual spaces for companies, including a display of oversized perfume bottles in Decentraland for L’Oreal, an area for what Huber calls one of the biggest beer companies in the world, and several forthcoming temporary, event-focused installations for the Cannes Film Festival, New York Fashion Week, and the FIFA World Cup. Spaces in the metaverse range from blocky low-bit video games to highly stylized architectural models. Global architecture firm Zaha Hadid Architects has dabbled in this space as well, with an entire metaverse urban design for Liberland, a self-declared micronation near Serbia and Croatia.

For all their technology and connection to cryptocurrencies, these spaces function a lot like real estate transactions in the real world. The adage about location being real estate’s top three considerations holds true in the metaverse as well. “Companies are willing to pay more to be in the right space,” Huber says, be it alongside a comparable brand or near a celebrity’s home. “The same concepts of proximity, how the price is created, and why you would buy versus rent, all of these are the same questions you would ask of physical real estate.”

Huber got started buying virtual real estate long before the metaverse was a common phrase, focusing on another type of money-making property familiar from the real world: billboard advertising. His company was founded to try to integrate advertising inside the actual game play of online video games, like billboards along the track of a car racing game or logos on the players’s jerseys in a soccer game. In contrast to other monetization efforts in this space, which tended to be disruptive videos that would halt a game and hope a player tuned in, Huber’s advertising effort was a lot more like the physical advertising people are used to seeing in the real world.

When the metaverse concept of a 3D virtual space began to gather steam, Huber saw an opportunity to create more than just virtual billboards. With $37 million in venture capital funding and about 100 employees, Admix has carved out a niche providing a variety of virtual real estate services to those interested in testing the waters. “We’re constructing financial products on top of the land where you can rent it, buy it upfront, or rent to buy,” Huber says. Despite these still being early days for the metaverse and its ability to draw users, companies continue to turn to Admix for help planting their own virtual flag.

For all his investments in the metaverse, Huber is under no illusions about it taking over the world. “We see this as a new social media channel, nothing more,” he says. “For some brands, it makes sense to be on Instagram; for some others, it makes sense to be on TikTok. [The metaverse] is another way for brands to tell their story in a different way.”

“These are just new ways for them to reach their customers,” Huber adds. As long as they want to, Huber’s company will lease them the virtual space to try.